Amazon Shipping, Amazon’s third-party logistics service, was previously offered in select U.S. cities before it went on hiatus in 2020. But around August last year, the Seattle company relaunched it , allowing the fulfillment of orders from outside the Amazon marketplace. This marks a new chapter in the company’s foray into parcel shipping, which could be far more disruptive to established delivery providers, notably UPS and Fedex.

What changes can this player bring to the carrier ecosystem? And what could it mean for small and midsize shippers? Let’s dive in.

The Facts

- Amazon has reintroduced ground shipping for sellers on its website, offering delivery for orders placed on Amazon.com as well as other channels.

- The service is called Amazon Shipping. It offers delivery of packages up to 50 pounds within the contiguous U.S. for Amazon sellers in two to five business days, including weekends.

- Currently, they don’t offer international shipping from the United States; however, they do offer domestic delivery within other markets such as the United Kingdom, France, Italy, Spain, and India.

- Amazon’s website does not disclose shipping rates, but notes that the service does not charge residential or weekend delivery fees.

- It is important to note that Amazon still uses UPS and the Postal Service to deliver many of its customer orders, but it has reduced its reliance on UPS over the years as its own network has grown. Last year, the company’s in-house delivery arm surpassed FedEx and UPS as the largest U.S. delivery business by package volumes.

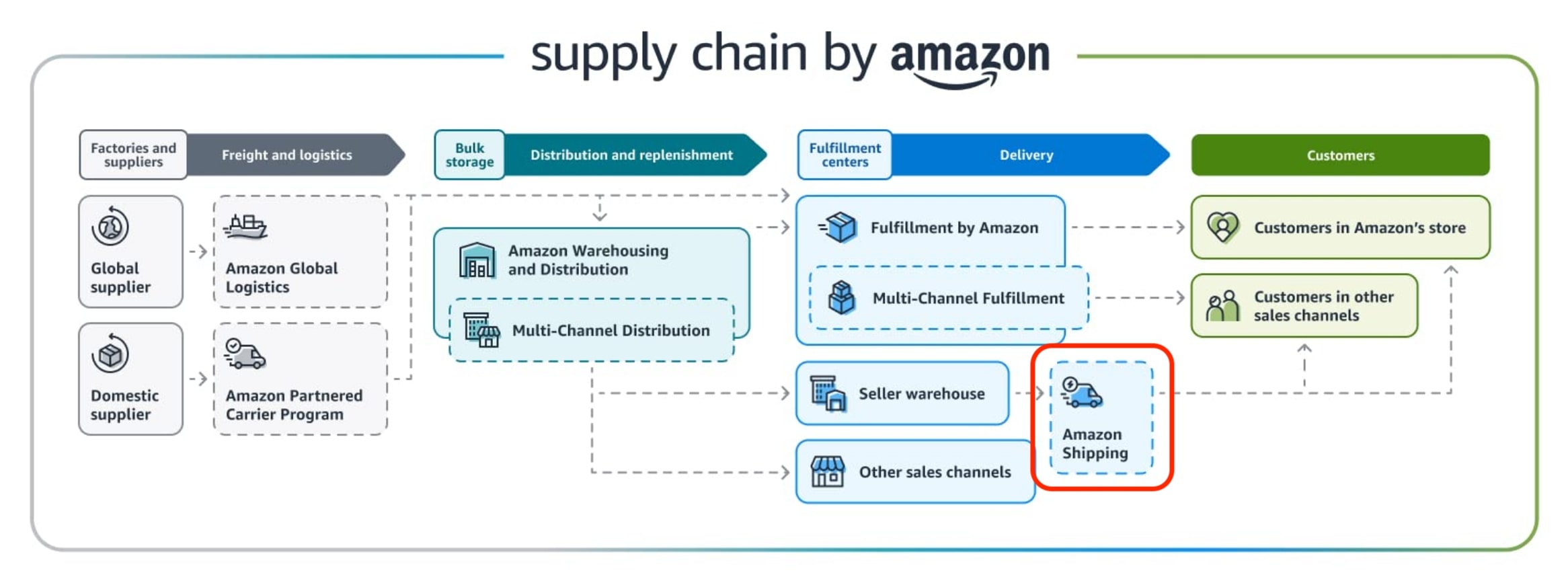

With Amazon Shipping, the company is betting that many of its marketplace sellers would be interested in using its delivery network for orders outside the Amazon.com ecosystem. The new service is part of an ongoing expansion of supply chain services, ranging from bulk product distribution to parcel shipping for orders placed through non-Amazon channels. The company has also been fine-tuning its fulfillment network to reduce excess operating costs while accelerating delivery speeds.

But regulatory pressure could eventually slow Amazon’s momentum. The Federal Trade Commission sued the company in September, citing Amazon’s fulfillment services as an example of anticompetitive practices.

Implications for the parcel market

If you recall, the last real challenger to the FedEx-UPS duopoly was DHL in 2001-2002, and it certainly didn’t go well for the new entrant. However, it would be shortsighted to draw comparisons to that exact scenario, as Amazon is playing an absolutely different game than UPS and FedEx. There are at least two factors that cannot be ignored out when talking about the Seattle giant:

Cash. Let’s not forget that other very lucrative parts of its business (AWS, anyone?) can subsidize its expansion in shipping. For example, since 2020, Amazon’s investments in its shipping network have been 10 times greater than those of UPS and FedEx. Ten times!

Its willingness to innovate. Amazon is anything but shy when it comes to funding R&D. They’ve been investing in artificial intelligence and machine learning for years, both to optimize internal processes and to provide a better customer experience (in fact, that’s where “same day shipping” comes from: they predict your purchase before you hit on the “buy” button 😉).

However, it is worth noting that Amazon is not the only competitor that has emerged. In particular, we’ve seen other players emerge in the local delivery space, such as CostCo, Target360, Walmart, or even DoorDash. They’re also going after this segment of the market, which is often overlooked by the two major carriers, as it’s the lowest margin slice.

Will this affect parcel shipping rates? What should shippers do?

On the one hand, it would be premature to judge Amazon’s moves solely on what it does with its shipping service. Remember, this is only a small part of a much bigger picture:

I would venture to say that, as long as it doesn’t interfere with its overall Supply Chain offering – of which third-party shipping is only a small part- Amazon will continue to offer it, but I doubt it will become the company’s first priority.

On the other hand, it is to be expected that UPS and FedEx are not going to sit on the sidelines. We expect them to play aggressively to retain their B2C customers, especially the highest margins segments:

- Small and Medium Businesses.

- Returns (UPS recently acquired Happy returns, which should give us a clue).

If you’re a shipper, I’d say this scenario actually looks good for you: you now have more options to choose from now. I would consider working with multiple carriers at the same time, taking advantage of the best rates each one has to offer, in order to get significant earnings.

Sure, carrier hopping can add more complexity to your day-to-day operation, but that’s where freight auditing software, like our Betachon Freight Auditing solution, can really make a difference. Our machine-learning software automatically checks each shipment for reasons for a refund, such as surcharges, late shipments, or overcharges. If it finds a reason for a refund, it will automatically file the claim on your behalf and make sure you get reimbursed.

I’ll hope you forgive my shameless plug, but we’ve made such a good product that I can’t help but mention it. I am a proud father ☺️..

I hope you found this information useful. And if you’d like a no-strings-attached demo of our software, feel free to email or DM me.