While ongoing oil glut has been increasingly painful to both US truckers and traditional petroleum exporters worldwide, it’s also been a welcome relief to the average driver. As the fuel for our cars comes from the same oil as the airplanes and trucks that move our freight, common sense would dictate that the same lower costs to move us would translate into lower costs to move our packages – in the form of reduced fuel surcharges. However is that always necessarily the case?

The theory behind fuel surcharges

The official explanation given by freight carriers as to why fuel surcharge exist in the first place is to help them hedge against volatility in the price of fuel. In short, they can maintain a steady upfront cost while still covering the bottom line by passing on extra expenses of fluctuations in the fuel market to the customer.

Some feel that’s a bit disingenuous given the pretty essential part fuel has to play in the shipping process. To put it one way, imagine a pizza restaurant maintaining the average price of a pizza on the menu, but suddenly tacking on an extra fee for dough at cash register. Now, if a single restaurant were to do this they would most likely lose all their clientele pretty quickly. But if EVERY pizza shop started doing this there wouldn’t be much alternative other than having to grin and bear it. Unless of course you just chose not to eat pizza anymore.

However businesses which rely on moving goods don’t have the luxury of choosing to stop shipping. And since the major carriers all play the fuel surcharge game we’ve got to play along – unfortunately according to their rules.

What’s been changing

During recent years FedEx and UPS tended to lean towards making the general price (which itself tends to undergo an annual increase) more inclusive of the fuel. However this past year they both split off their index of fuel surcharges from the increase in the base rate. One of the effects of this change is that even shippers who had pre-arranged discounts will now have to fully pay the fuel surcharge separate from whatever price had been negotiated for them.

FedEx and UPS justify these surcharges as of late mainly with the claims of an uptick in shipping for eCommerce which entails two things:

- More deliveries going to residential destinations and…

- A lot more non-traditionally shaped boxes

Neither of these claims seem to hold much water as residential shipments anyway get charged a higher rate than commercial, and conventional wisdom dictates that no matter what crazy things people may be buying online these days, the majority of boxes out there are still rectangular shaped. But hey – that’s their story and their stickin’ to it!

In general, the fuel surcharge indexes tend to more or less follow the market price of fuel, based off whatever the price was roughly two months prior. However the carriers themselves pay fairly close to current market fuel rates. This can sometimes lead to discrepancies in which changes in the price of fuel are not being proportionately passed on to the client…

The devil is in the details

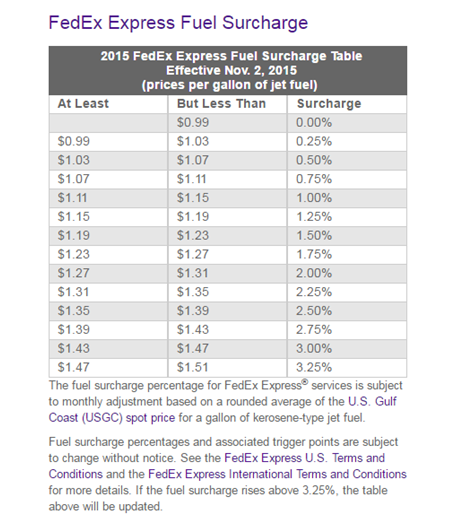

An interesting case was reported by The Motley Fool two months ago involving FedEx. They have two main fuel surcharges – one for express delivery based on jet fuel prices, and the second for ground delivery based on diesel. According to a previous table of surcharges a minimum surcharge of 0.25% was applicable for express delivery. The price range for this surcharge was when jet fuel was between $0.99 per gallon and $1.03 per gallon.

The thing is, during the time this surcharge table was in place the price of jet fuel actually dropped below 99 cents a gallon. So while FedEx was spending less money to fly their planes than the lowest price listed on their table, clients still were required to pay a minimum of 0.25% – with FedEx profiting from the difference! In fact, the whole reason the Motley Fool was bringing this to people’s attention in the first place was to point out the great potential earnings FedEx stood to snag making it a great investment pick!

Now, of course, in theory some major cataclysmic world event could occur thrusting fuel prices far above the maximum price listed on the table. However FedEx is quick to note that “Fuel surcharge percentages and associated trigger points are subject to change without notice” They also state if the price rises above their highest one listed then the percentage surcharges will most indeed be updated.

So even as frightening as current world events may be, don’t get too excited – in the event of WW3/Armageddon/Fill in the blank, there will still be some accountant somewhere at FedEx headquarters ensuring you won’t be able to pull a fast one on them and avoid paying the full surcharge!

As of this writing the surcharge percentages have since been updated and the prices listed seem to be in line with current fuel prices for both jet fuel and diesel. Additionally, the new minimum surcharge for express shipping is now zero – perhaps in response to the above mentioned price movements in January.

(From: http://www.fedex.com/us/services/fuelsurcharge.html)

So for the moment, FedEx is playing fairly (assuming you believe that it’s fair to charge extra on top of the regular price for fuel in the first place!). However this just goes to show the potential that fuel surcharges have to get in the way of your business benefiting from favourable moves in the oil market. If you haven’t already, be sure to sign your business up with Betachon to guarantee you’re not getting taken for a potential ride by your carrier.